When Vendors Want to Be Paid Like Equity Parters

July 13, 2021

I frequently advise agencies and clients as they navigate the often-confusing landscape of various software services, competitors and substitutes, usually concluding with a forecast of business under various scenarios. To add to the confusion, I’ve seen more services pricing their services not as a fixed monthly fee, but as a percentage of sales.

In a general sense, we would think of a true business partner who shares in our success, as well as some risk of failure, as an equity partner. We typically think of vendors and suppliers as important partners to success, but usually not as equity partners ( as they do not fully share our risk).

We’re familiar with lots of products and services sold at a fixed cost per unit (like a broom), a subscription price for a one-month period (like paid email or Netflix) or a fixed rate per unit x units consumed in a period (i.e. utilities like electricity and gas). By way of analogy, if we were to buy a broom to sweep up your shop floor (in a ‘brick & mortar’ universe), that broom might cost roughly $20, independent of how many times you use it. If you sweep ten times, or ten thousand times, the cost of the broom is the same. This is the fixed or non-equity pricing model: you pay the cost one time, and keep all of the economic surplus of owning and using the broom.

A vendor who has visibility to your revenues, however, may charge for services on a percent-of-revenue basis. I think of this as an equity-seeking pricing practice: such vendors are extracting a kind of equity partnership.

How should we view such services for our business that are priced relative the success we achieve when using them?

Equity-seeking

A couple of examples of equity-seeking and non-equity pricing in ecommerce vendors:

Payment providers: if you sell anything over the internet, you’re likely to be using a Payment Facilitator (aka 3rd-Party Processor) like Stripe or similar under the hood. If not, think of it like PayPal for the sake of discussion. As our non-equity alternative, Payment Depot is one of several merchant services providers that charge a flat monthly fee (plus wholesale interchange and assessment fee that gets paid to the credit card networks and banks, usually 1.5% or less).

eCommerce back-end providers: This is a relatively new approach that I love in the ecommerce space. These platforms will do all the heavy lifting for the 'back-end' of your 'shop' (products, prices, shipping rules, taxes, etc…), but won’t impose their opinions on how you design the 'storefront' (i.e. the actual website design). Also known as ‘headless’ eCommerce, allowing you to drop a shop into any type of website you want. Ecwid charges a flat monthly fee and Snipcart utilizes the less common ‘equity-seeking’ approach.

Non-equity

Vendor category

Equity-seeking

Which type of cost structure is better for your business?

Assuming services are comparable across equity-seeking and non-equity, their cost structures can be compared.

If you’re just starting out, equity-seeking may look more attractive as you will have $0 in overhead (from this service) as long as you have $0 in sales. This is how an equity partner shares the risk of the downside: keeping their service online for you to use, at no cost to you, before you can pay for it.

However, assuming we expect said business to eventually launch and grow, it is reasonable to question this pricing model. Since the marginal cost of processing more checkouts to an ecommerce back-end service platform, for example, is relatively small (like the broom maker’s non-existent incremental cost of your ten thousand swept floors), it is fair to question whether equity-seeking is reasonable.

Generally, equity-seeking by a vendor would be fair when the value provided adapts and matures with the growth of your business. For example, a consultant that you hire and compensate with a revenue share of the business would be fair if the guidance adjusts appropriately as your business grows through various stages. That consultant would be helping to better leverage assets and increase the value provided to your customers/clients (or to reach more of them) as the business matures, and not just giving you a tool to do do more work yourself (and importantly, the revenue share is an important incentive for the consultant to deliver such results). If the fundamental value is generally unchanged as your business grows, such as a consultant who provides an fixed-scope advisory package only to companies in the startup phase, or like our broom which we use to sweep more floors, then we should be considering fixed or non-equity priced services.

Why not consider using both at different stages?

It may be feasible to start with an equity-seeking vendor, and switch to a non-equity vendor when the time is right if:

- Services (or substitutes) are close enough in features and benefits

- All vendors are no-contract, month-to-month services

- Other switching costs are not prohibitively high (like integration costs, time required to learn a new platform, etc.)

When to switch?

We’d need to know what volume of sales it becomes more cost-effective to use a flat-fee, ‘non-equity’ service. Fortunately that is a simple equation:

Vbe = [ nem ] / [ P x (ev - nev) + ef - nef ]

Vbe = your monthly sales volume (or typical monthly service volume) at break-even for switching from a equity-seeking to non-equity vendor

P = your average transaction revenue (or unit price if a single product, or service fee)

nem = non-equity service fee / mo

nev = non-equity variable or % of sale*

nef = non-equity flat per-transaction**

ev = equity variable or % of sale

ef = equity flat per-transaction fee

*In the example below, there is an interchange fee. This is not a payment to the vendor, but rather a wholesale cost that the vendor must pass through to you.

**Unlikely from this type vendor, but it is possible that some vendors may charge a small fixed fee per transaction (as opposed to a % of every sale).

Using the information for the example vendors from the table above, we can estimate the optimal sales volume to switch from an equity priced payment provider like Stripe, to a non-equity provider like Payment Depot (note pricing is subject to change and other account setup fees may apply):

Assume P = $35

Vbe = [ $79 ] / [ $35 x ( .029 - 0.015 ) + 0.03 - (n/a) ] = 152 units x $35 = $5,320 monthly revenue

Switching costs

The big challenge of switching from equity-seeking vendors (like Stripe) to non-equity vendors (like Payment Depot) has more to do with the disruption, vs. any real technical or cost hurdles. The perfectly reasonable question is 'is it worth the trouble?' There is never going to be a deadline to force such a change, nor is there ever going to seem like a great time to stop and do it. But as with any good investment, we can see dividends paid into the future.

What's it worth?

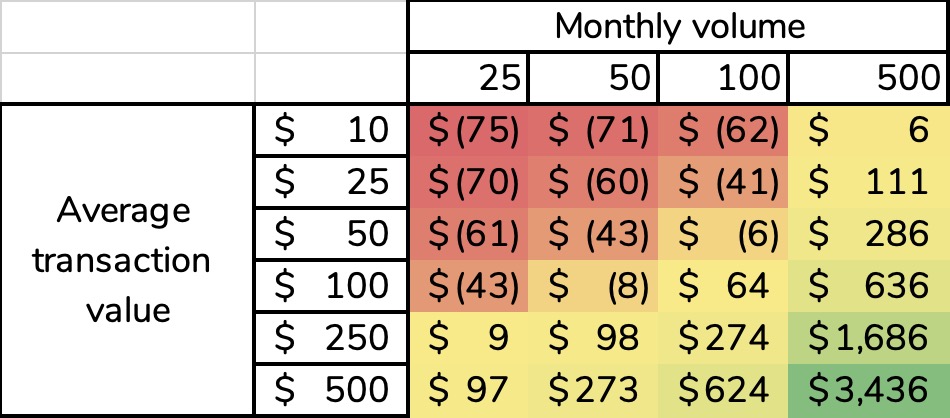

A better way to answer the question 'when to switch' may be: 'Can these savings pay for a different kind of investment that I’ve wanted to make in my business, but could not justify purely on a financial basis?' Perhaps upgrades to an ecommerce platform, a better CRM, etc. are funded through this strategy. Because as the table to the right (or below) shows, at a certain volume the savings become a significant recurring value which grows with your business.

Monthly Payment Processing Savings from Example Above

We love to share

our experiences

When Vendors Want to Be Paid Like Equity Parters

Are you all too familiar with a 2.9% processing fee to receive payments in your business? I think of this pricing scheme as ‘equity-seeking’. Are there any alternatives?

Etsy Sellers: Replace Your Profit at Half the Cost

If you rely on income from your Etsy shop as your main source of income, the stakes are a bit higher…this is for you.

If you had already experienced a remote social event yourself pre-coronavirus, you may have concluded the main ingredients of the IRL equivalent were there.

…A much savvier approach is to use single-use, custom coupon codes, or a unique coupon code created for each individual customer.